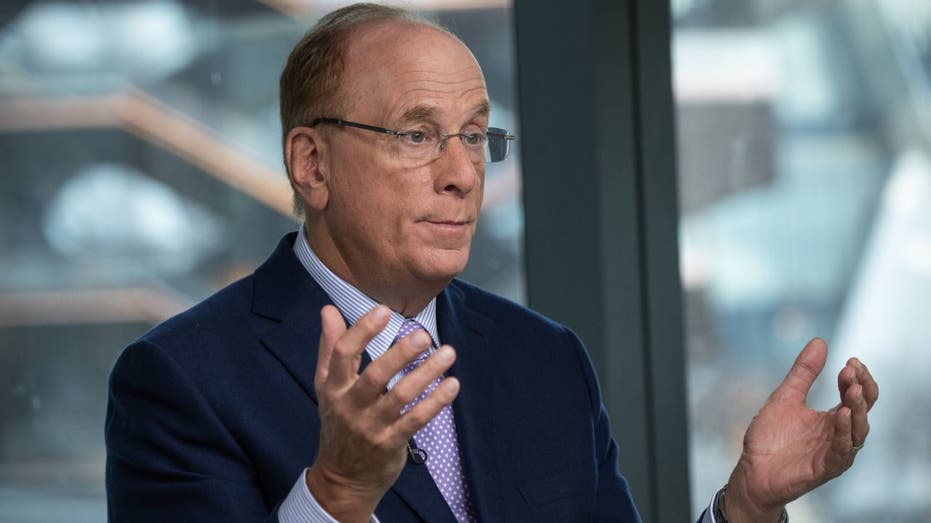

Blackrock President and CEO Larry Fink gives his task on market instability on tariff talks with China and ‘The Claiman Countdown’.

60/40 portfolio, stocks of bonds, have long been tried for those who manufacture their retirement nest eggs with the safety net of diversification. But the Times, they are recommending a change and Blackrock CEO Larry Fink.

“Generations of investors have performed well after this approach, owning the entire market mixture instead of individual securities. But as the global financial system develops, the classic 60/40 portfolio can no longer represent the correct diversification. The future standard portfolio may look more than 50/30/20/20- Stock, bonding, and personal assets, which can look more like a private portfolio. For infrastructure, infrastructure, infrastructure, infrastructure, and private credit.

Blackrock CEO Larry Fink’s annual letter to investors

Larry Fink, Chairman of Blackrock Inc. and Chief Executive Officer, Right, and Global Infrastructure Partners (GIP) Chairman and Chief Executive Officer, Adebayo Ogunlesi, during a Bloomberg television interview in New York on 12 January, on 12 January. (Photographer: Victor J. Blue / Bloomberg via Getty Image / Getty Image)

In the case of infrastructure, Fink postponed its inflation protection characteristic; He said that he said solid returns, as well as 10% allocation from payment, stability vs. volatile public markets and solid returns.

Blackrock recently paid $ 23 billion for the Panama Canal ports. As an example, revenue can be generated by charging the fees of vessels to pass through the waterway.

Blackrock Pays $ 23 billion for Panama Canal ports

| Langer | Security | Last | Change | Change % |

|---|---|---|---|---|

| Black | Blackrock Inc. | 875.75 | +9.64 |

+1.11% |

Even though Blackrock, is the world’s largest asset manager with more assets, 50/30/20 mixture or other partitions, small, retail investors with alternative property.

“For someone who has a lot of time ahead of him and he has assets to justify an allocation for personalities, we think it is really an exciting opportunity because it is due to diversification providing to a portfolio,”, Katie ClingesmithThe main investment strategist in Edelman Financial Engine, told Fox Business.

Mortgage Rate Spike amidst the instability in the market

“Generally from our perspective, when we think about the creation of a really strong portfolio for our customers, but when we also think that what we think is the best for the majority of investors who are not necessarily ultra-high net worth. There are really some interesting features in private markets, and it will be quite a thrill to see how they give up this period.

S&P 500, widespread remedy for US stock market, lost 10% this year.

Get Fox Business when you click here

Morningstar’s US Core Bond Index is about 2% this year. According to the firm, it measures fixed-per, investment-grade US dollar-dilominated securities with maturity of more than one year.